New Research Highlights the Importance of Streaming for Sports Properties and Marketers

When the NFL announced in March its new media rights deals valued at more than $100 billion over 11 years, it opened the sports industry’s eyes wider to the prominence streaming has with the country’s most popular sport. The league’s new partnerships include streaming games and other programming across a suite of platforms, including “Thursday Night Football” moving exclusively to streaming in 2022.

Other sports properties are sure to follow the NFL’s lead by continuing to make more of their content available for streaming, and the trend figures to go beyond the big four of football, basketball, baseball and hockey. Americans have a voracious and deep appetite for sports, eager to consume any and all sports content year-round, a notion confirmed by a recent study commissioned by Tubi, Fox Entertainment’s ad-supported video on demand (AVOD) service.

The study found that seven in 10 males ages 25-44 watch six hours of sports a week, and one in three females ages 25-34 watch more than four hours of sports content each week.

The breadth of sports fans’ interest stood out to Karl Dawson, Tubi’s Vice President, Audience Research.

“We asked about the top 30 sports, based on popularity among American viewers,” Dawson explained. “I expected top-two box interest on a five-point scale to be maybe seven or eight sports – what we found was that 24 percent of the general population was interested in 13 or more sports.”

The sheer number of sports that grab fans’ attention was a key takeaway from the survey. Here are three more:

Breadth and depth of content

While fans love the thrill of live competition, their appetite for sports content is far broader than that. Programming that drives interest and engagement, according to the study, includes classic games and events, highlight shows, documentaries, condensed replays overlaid with commentary, interviews, debate shows, reality programming, and of course, sports betting and fantasy.

Among the male 25-44 demo, for example, while 69 percent of those surveyed said they are interested in live sports events, 11 other sports content categories saw interest ranging from 68 to 72 percent.

“There’s a consistency of interest and tight following between what we presume is the most appealing sports format – live sports events as they occur – and then every alternative format and type of content,” Dawson said.

When it comes to the wide variety of content sports fans seek, streaming is a robust complement to linear TV.

“Long tail of content,” Dawson quipped. “We can show all kinds of things, we can offer more channels, we have the opportunity to navigate to whatever in particular might interest incremental streaming audiences.”

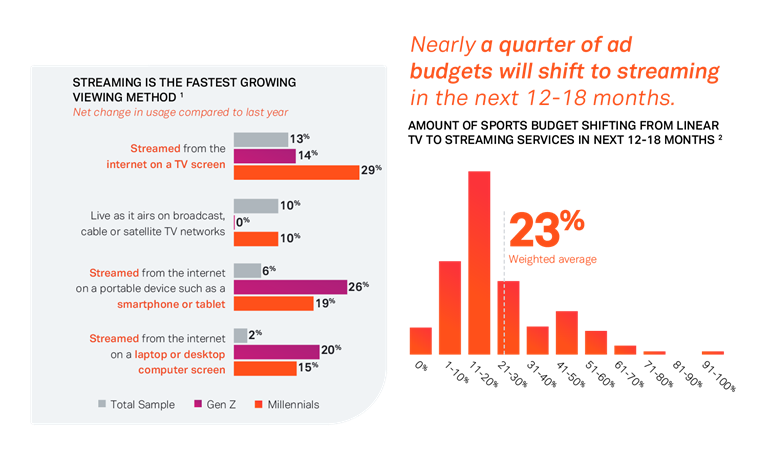

Generational shift

People of all ages are turning to streaming at increasing numbers, but the trend is more pronounced among younger demos. While 64 percent of U.S. consumers ages 13 plus say they stream weekly, that percentage escalates to 78 percent of Gen Z and 82 percent of Millennials. In fact, these younger generations are streaming most of the content they watch.

This is critical information for advertisers trying to reach incremental audiences, according to Cynthia Clevenger, Vice President, Sales Marketing at Tubi.

“There is a huge subsegment of new viewers who are sports fans and are getting their content much differently than where ad dollars have traditionally been spent,” Clevenger said.

Digging deeper into the study, Gen Zers did not convey the same level of interest or engagement in sports as their older counterparts.

“The key cutoff right now has been 25 plus,” said Dawson. “We're curious to see where Gen Z goes with regard to sports streaming interest. We do believe that it's a veritable opportunity – both for Gen Z, as well as the explicit hand raising from Millennials in terms of their interest.”

Sweet spot for advertisers

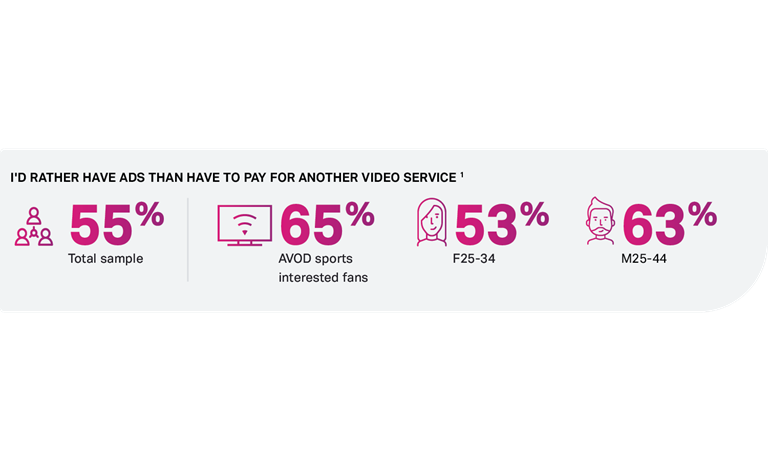

U.S. consumers are experiencing subscription fatigue. That is, they are tired of having to register and/or enter their credit card number for yet another OTP service; most would rather see ads.

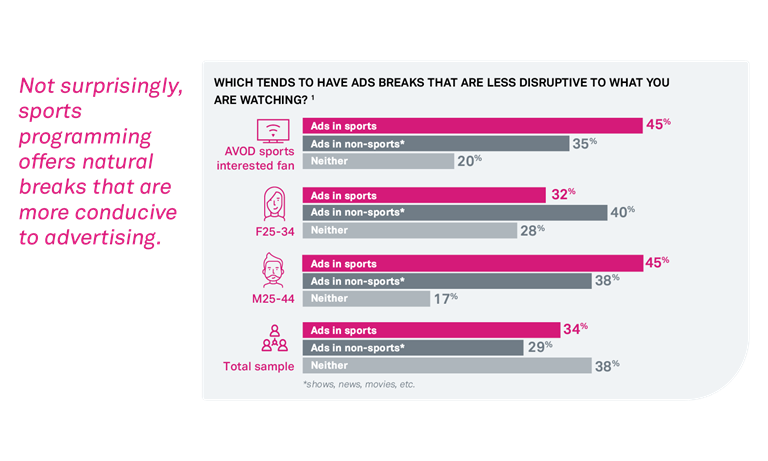

This is good news for AVOD (advertising-based video on demand), a medium well-suited for sports viewership. Sports fans are more accepting of ads during sports events than, say, during a sitcom or movie, as they are accustomed to seeing ads during halftime and timeouts, the survey found.

“That's reassuring to us, and it fits with sports programming in general,” Dawson said.

This is also advantageous to advertisers. While a separate Tubi-commissioned study found that brands and agencies plan to shift about 15 percent of their overall advertising budgets to streaming, that percentage spikes to 25 percent within the sports category. It’s a trend that dovetails nicely into where sports content is heading. For brands trying to reach incremental audiences, exploring streaming alongside linear is becoming key to reach younger sports fans.

“We can expect more major content providers and leagues to be making (shifts to streaming), and that totally benefits the consumer, especially in an ad-supported environment,” Clevenger said. “It's a real win for all: it doesn't cost consumers extra money, it gives them what they want when they want it, and in a viewing experience that the younger audiences are completely used to watching TV on.”