NFL Secondary Ticket Prices Have Not Suffered Due to the Pandemic, But Home Field Advantage Has

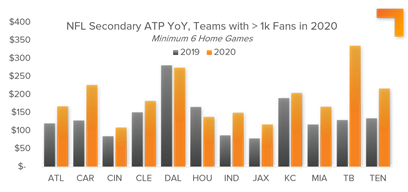

The 2020 NFL season may have been novel in many respects, but it amplified two trends appearing in recent seasons: secondary prices went up, and home field advantage went down. Over the course of the season,12 teams hosted more than 1,000 fans to 6 or more games (75% of the regular season), with half of them doing so for the entire regular season (8 games). These 12 teams sold roughly one fifth of their 2019 secondary volume – and with this constrained supply, 10 of those teams saw growth in their secondary prices YoY for sales on or after August 13 (when re-manifested tickets went on sale in 2020).

The Tampa Bay Buccaneers reaped the benefit of the free agency signing of Tom Brady (+159% YoY), but even excluding them from this comparison, the other 11 teams saw an average ticket price growth of 18% YoY.

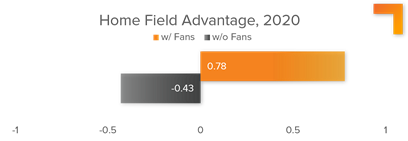

These fans in the stands did provide a homefield advantage. For all games with more than 1,000 fans, home teams won by an average of .8 points per game – compared to losing by 0.4 points per game for all games played in front of no fans (or only friends and family). In other words, games played in empty stadiums actually benefited the visiting team.

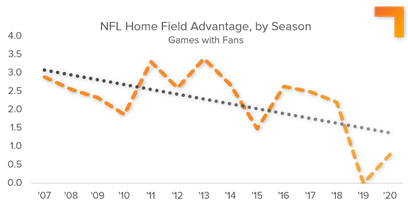

The question is whether 2020 was an outlier or simply a continuation of a recent shift: over the past 13 regular seasons, the average home field advantage has been 2.3 points per game. But last season (2019) exhibited a sharp drop to -0.01 (essentially no difference between home and away), and over recent seasons this on-field factor has appeared to be declining.

It should also be noted that in the postseason, the magnitude of home field nearly doubles – from 2.3 points per game in the regular season to 4.4 points per game in the postseason over the last 13 seasons. If this pattern holds true for this year’s pandemic-altered playoffs, we would have expected an average advantage of ~1.5 points per game for the playoff hosts with fans in the stands.

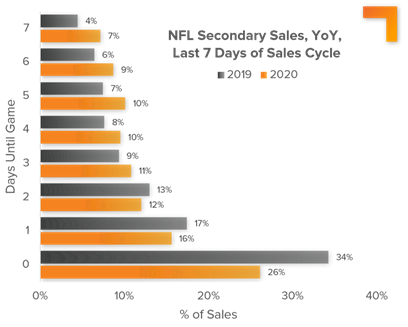

Returning to the topic of secondary purchasing behavior, the previously illustrated group of 12 teams that hosted more than 1,000 fans to 6 or more games did see a shift in the sales cycle – consumers actually bought their tickets slightly earlier, even with the added uncertainty around game postponements/player availability. Of the tickets purchased in the last 7 days leading to the game, In 2019 34% of secondary buyers purchased their tickets on the day of the game; this year, that figure fell to 26%.

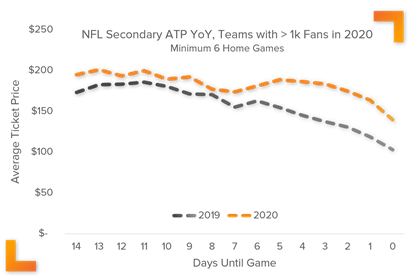

Even though when buyers are making their purchases subtly shifted, the rate of price decay over the last two weeks before the game is extremely similar to 2019. With prices on the whole rising year-over-year, this season’s price decay curve was elevated over every single day in this 14-day segment of the sales cycle and followed roughly the same slope of decay as last year.

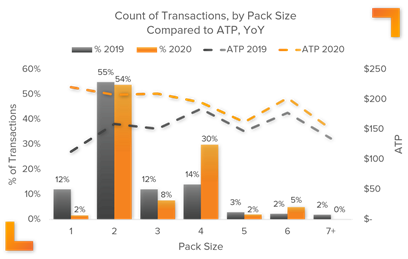

An additional mandated change in buyer behavior was reflected in which pack sizes were purchased. With pod restrictions in place across the country due to social distancing, groups of four tickets saw a large increase as a percentage of overall sales, at the expense of virtually every other pack size. While every pack size increased in price YoY, these restrictions also led to an abnormally high premium being placed on smaller groups – quantities of 3 or less. 1-packs rose 95%, 2 packs increased 30%, and 3-packs jumped 39%. From there, packs of 4 or more saw about the same lift (around 12%).

The impacts from the COVID-19 pandemic can be seen across the world throughout every industry, and the NFL is no exception. Through the unprecedented 2020 season, we have seen some trends continue (the decline of home field advantage and the rate of decay on ticket prices as an event nears) and have seen new ones arise (shifts in the timing of sales and the pack sizes of tickets being sold). Only time will tell whether these observations were merely a function of the times, or trends that will continue into normalcy.

Logitix (formerly Dynasty Sports & Entertainment and AutoProcessor) provides a unified ticketing system that combines inventory management, distribution and fulfillment automation, ticket exchange and data insights to help clients make the most of their inventory.