How Teams and Venues Can Make Fan Data Actionable

Teams and venues have an abundance of data about the fans who buy their tickets and attend their events. From demographics to zip codes, from purchasing behaviors to the frequency of visits, there is no shortage of information within reach.

The challenge comes with what to do with the data: How does a franchise or venue owner use it to boost their business?

“Thousands of data points are of no use unless you can discern the larger patterns and trends,” said Sezin Aksoy, Senior Vice President, Global Data Strategy and Analytics, AXS.

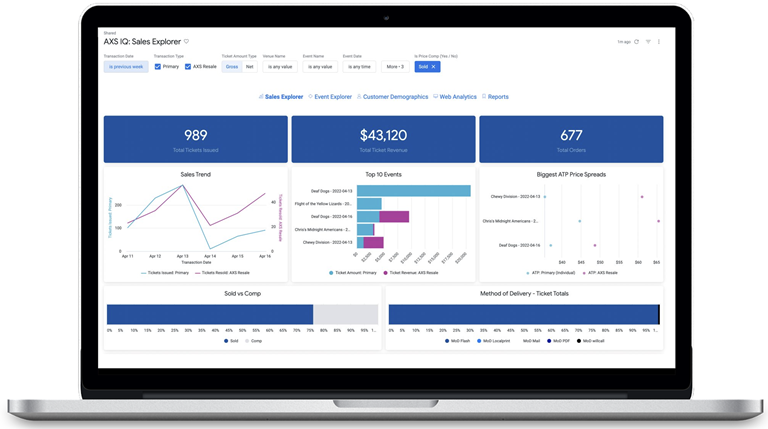

The right platform can make data actionable. AXS IQ, a web-based business intelligence tool, combines multiple data sources into one place and generates dashboards to help augment and scale sales cycles, enhance fan experience and pitch sponsorship add-ons.

Also, the tool automates reporting that team or venue staff would otherwise have to spend time building, likely in Excel.

“We deliver data to decision-makers when they need it, make it accessible and provide a tool for them to explore and drill deeper,” Aksoy explained. “That takes a lot of work off their plate.”

Here are four ways franchises and venues can turn data into action:

Optimize Ticket Sales

Through the AXS IQ dashboard, an AXS client can see and set automated alerts to be notified when ticket sales spike, what tickets are selling for on the primary vs. secondary markets, when website traffic peaks , which zip codes are the hottest sellers and more.

A team can monitor, for example, if certain sales tendencies are associated with specific geographic locations. Are more single-game tickets being sold downtown while season-ticket packages are selling better to suburbanites?

Teams can also observe when tickets are selling, allowing them to tailor sales campaigns to those trends. Perhaps presale is bringing in an influx of new customers, providing an opportunity to fire off a newsletter and introduce these new people to the team, brand or venue.

The tool also can help users find the right price levels by serving up information about the secondary market.

“We can start to understand where the market is observing arbitrage opportunities – when the resale is much higher – or if people are reselling them for lower,” Aksoy said. “The data points and analyses help teams dive deeper into customer segmentation as well – do the price-sensitive customers always buy on secondary? Are people from out-of-town checking prices on secondary first?” she added.

A web analytics function offers a detailed look into the e-commerce funnel – where web traffic is coming from, how many visitors and page views, conversion rates and revenue it is driving.

Create Targeted Marketing Campaigns

While AXS Mobile ID – a revolutionary identity-based ticketing technology – allows users to grow their customer database – with AXS IQ, they are able to see how particular demographic groups interact with the ticket, learn more about the groups and ultimately create action targeting specific groups.

Through demographic, geographic, lifestyle and behavioral data, customers are segmented into clusters such as these examples:

- Career builders – single adults, no children, age 18-45, renters or first-time homebuyers, white-collar jobs, post graduate degree

- Summit estates – wealthy, married, parents, high levels of education

- Top professionals – high income and net worth, predominantly professional, technical, management jobs, average age of 50, homeowners, mixed-age children, three-quarters are married

- Established elites – couples and singles, no school-age children at home, some of highest income in US, suburban homes, high net worth and disposable income to pursue high-end luxuries and activities

- Action lifestyles – established couples and some singles living in suburban areas, school-aged children and teens, multiple vehicles and mortgages, high education, managers. Top-ranking incomes

Users can filter databases based on these segments to create customized campaigns.

“Sometimes it’s the change in demographics that you really feel for particular events,” Aksoy said. “Game to game we might not see a big difference, but if there’s a new event or concert coming in, we may notice a huge skew in age group, and we know that’s a potential area we need to understand – if it’s an older clientele or younger or wealthier clientele compared to what we typically get.”

Sell Sponsorship Add-Ons

Detailed demographic data is of massive value to marketing partners.

An event well-attended by the career-builders cluster may be of particular interest to a beverage brand, while a luxury car brand might be targeting an audience consistent with summit estates. The dashboard allows teams to put together pitches tailored to such sponsors.

“If there’s a brand that is looking at a similar demographic,” Aksoy offered, “they can go to this brand and show this data and say, ‘Hey, this is a great event for you to sponsor.’”

Enhance Fan Experience

Knowing which groups are attending which events can also help create an experience more enjoyable to customers and more profitable to the venue.

Younger age groups may prefer different food choices than older ones, and wealthier demos are probably more drawn to the premium areas of the arena or stadium.

While AXS IQ is essentially a ticketing data platform, information gleaned from the tool can be applied to tailor offers to the specific customers coming through the doors.

“We can identify specifically the demographics of the audience that is coming to the event – not just the buyer,” Aksoy said. “By comparing this audience to past events or understanding these types of cohorts, a venue can optimize its offering for each event.”