When we last spoke, I bemoaned not being able to legally wager on the Super Bowl from our home here in North Cackalacky. Having missed the +1250 parlay that I fancied by a single stinking point, I’d like to thank our state legislature for protecting both me, and the remote that I’d have hurled across the room when the total went to 40.

Lots to cover today -- with some Easter eggs waiting at the bottom.

Sports Betting Taking Larger Share Of MGM Efforts

BetMGM CEO Adam Greenblatt fielded as many questions as parent company CEO Bill Hornbuckle during MGM Resorts’ latest earnings call, a testament to analysts’ interest in the emerging sports betting segment and the surge MGM reported on that front in the fourth quarter.

It has been a dizzying spate for the well-known, but slow-out-of-the-blocks casino giant of late, as BetMGM has launched in five states in a span of 87 days. But with its tech cemented and its footprint growing -- opening at the same time as its competitors in Colorado, Tennessee, Michigan and Virginia -- the numbers have begun to swing.

In its presentation, MGM pointed to its position as the market-share leader in Tennessee (34%), second place in Colorado (31%) and third in New Jersey, Indiana and West Virginia -- all based on gross revenue -- as indications of its emergence alongside the two legacy DFS brands (FanDuel and DraftKings). Hornbuckle said BetMGM’s market share across six states was 17% for Q4 -- rising to 19% when excluding Pennsylvania, where it launched in mid-December.

Early Start, Titans Partnership Fuel MGM In Tennessee

Tennessee was especially good news for the company, evidence that it could compete strongly even without the advantage it expects to hold in states that also allow online casinos.

“For me, Tennessee is the poster child of our ability to compete against the early leaders in a sports market only,” Greenblatt told analysts. “We were there on Day 1. All the components of our operating model were in place right from the start. We have the right partners -- the Titans. Put all those things together combined with product, CRM, the acquisition machine working, and we’re demonstrating that we can fight and win toe-to-toe with the best.”

Another key number the company shared from Tennessee: $13 million in account deposits in the state, an indication that players are not simply taking advantage of free bet promotions and then bolting to place the next free bet at another site.

“The moment of truth is our players actually putting hard-earned money into an account to play with us, rather than it being purely bonus money; incentive money,” Greenblatt said. “The importance of that $13 million is that it demonstrated the scale of fuel to drive (net revenue).”

MGM also laid out early numbers to support its long-held belief that its casino player base would provide a low-cost funnel for qualified customers, pointing to its MLife program as the leading source of new BetMGM players in the quarter, providing 17% of the site’s signups, with those that migrated from MLife from March to December delivering twice the value of other players.

It’s worth noting that BetMGM’s market share numbers are based on gross revenue -- the amount the sportsbook holds after paying winners -- rather than handle, the amount they wagered. The numbers you’ll read below are all based on handle, unless otherwise noted.

Online Accounts Drive Iowa Surge In January

Iowa sportsbooks showed the biggest gain of those in any state in January, thanks to regulations that for the first time allowed bettors to open accounts online, rather than at a brick-and-mortar outlet. Handle in Iowa rose to $149 million, up 43% over December.

Some other highlights from January:

- New Jersey came in just short of its first billion-dollar month for the second time, falling 4% to $958 million.

- Pennsylvania was up 12% for the second straight month, rising to $615 million.

- Indiana continued to tick ahead, coming it at $348 million, up 11%.

- Oregon was up 29% to $34.9 million, finally getting back the 15% it lost during a basketball-free November. Basketball accounted for half of the state’s handle in January, ahead of football, which fell to 29%. Hoops handle more than doubled from $8.3 million to $17.4 million from December to January, while football fell from $12.3 million to $10.3 million.

Market Share Battle Heats Up Across States

I can’t give you handle numbers without tracking the fight for market share in the states that make it public.

FanDuel still leads in Pennsylvania with 38% of handle, with DraftKings at 25%, Barstool at 11%, BetRivers at 8%, BetMGM at 7% and FoxBet at 5%.

In Indiana, it's DraftKings in front at 41%, followed by FanDuel at 30%, BetMGM climbing to 18%, PointsBet at 5% and BetRivers at 3%.

FanDuel is ahead in Indiana at 55% to DraftKings 40%, with William Hill at 4%.

The picture is about to get murky in Iowa, where regulators will tack recently launched BetMGM and BetRivers onto the reporting of FanDuel and DraftKings, respectively. William Hill still led there in January, at 33%. DraftKings/BetRivers were at 25%, while FanDuel/BetMGM were at 22%.

The latest numbers from Illinois are from December, but they’re still worth a check-in: DraftKings led at 40%, FanDuel was at 29%, hometown BetRivers at 23%, PointsBet at 7% and William Hill at 2%.

NHL's Wachtel Talks Accepting Equity In PointsBet

Keith Wachtel, the NHL exec who was one of the industry’s early embracers of sports betting, harkened back to the league’s long ago investment in DraftKings when discussing its recent acceptance of $500,000 in PointsBet stock as part of a sponsorship and authorized betting operator agreement. The league will receive the shares in equal portions over the next three years.

The NHL and MLB both were early investors in DraftKings, while the NBA invested in FanDuel.

“We obviously have to be careful (accepting equity in the deal),” said Wachtel, the NHL’s chief business officer. “But we would be just as careful taking equity in any partnership as we would a sportsbook. This is a way to align, our interests, but at a very minimal level.”

The relationship is a crucial one for PointsBet, which has an exclusive deal to provide odds and other betting content for NBC Sports. The NHL is a cornerstone property for the network, which took a nearly 5% stake as part of its deal with PointsBet, an Australia-based company that has made Denver its U.S. HQ.

Wachtel compared the NHL’s equity stake to official data deals that the NBA and MLB have with operators, which pay the leagues small percentages of handle from their respective sports.

“Whether it’s a percentage of handle or some sort of equity component, people see it as a way to align interest,” Wachtel said, “and to make sure they’re generating the right value from the assets.”

Also from the NHL this week: A deal to add Bally’s to the league’s roster of official sports betting operators, an essential step for the sportsbook as it rebrands the many Sinclair regional sports networks that carry NHL games in legalized states. Bally’s gets access to league and team marks and use of official data.

FanDuel, DraftKings Lead Charge In Michigan

And in Michigan, where state gaming regulators released figures from the first 10 days of online betting, which opened on Jan. 22: Not surprisingly, the numbers were boffo, and dominated by four brands in the most competitive launch of any state thus far.

Eleven sportsbooks combined to handle $115.2 million, spurred by an opening weekend that included the NFC and AFC championship games.

Four sportsbooks accounted for almost all that activity, with FanDuel leading at $32.6 million, followed by DraftKings at $28.2 million, Barstool at $27.5 million and BetMGM at $22.8 million. Each claimed a 20-28% share of handle, a previously unseen balance in a space that has been dominated by the legacy DFS brands at the start most every other state. FanDuel, Barstool and BetMGM each benefit from connections to the three Detroit casinos, where they have branded the sportsbooks and struck up relationships with loyalty program members.

The rest of the field: PointsBet ($1.49 million), BetRivers ($1.07 million), William Hill ($692,000), Twin Spires ($327,000), WynnBet ($249,000), Golden Nugget ($107,000) and FoxBet ($106,000). FoxBet was open for only the last three of the nine days.

SBJ this week took a deep dive into what has made Michigan so competitive -- and a state that gaming interests will hold up as a model for those that come next.

Brand Recognition: What's Your Name Again?

Some interesting survey data from radio giant Westwood One came across the digital desk this week. A panel of 700 over-21 Michigan residents weighed in on a range of questions fielded from Jan 29-Feb 1, one week after the state launched online sports betting.

The low level of unaided awareness of sportsbook brands was particularly striking, as only 45% of respondents could name any. FanDuel and DraftKings were at 22% and 16%, respectively. BetMGM was the only other brand in double digits, at 11%. PointsBet and Barstool were at 1%.

Aided awareness numbers were predictably higher.

Simplebet's Free NFL Game Drives In-Play Bets

Free-to-play games clearly have found an audience in the U.S. The question is how much of that audience will actually migrate to real-money betting. And how much will they wager, how often.

It’s too early to say, but Simplebet CEO Chris Bevilacqua came out of the Super Bowl with an interesting, albeit small-sample, insight.

Simplebet, which operated a free-to-play game on FanDuel’s DFS site this NFL season, rolled out its first real-money in-play game through Intralot’s Gambet app in D.C. in time for the NFL playoffs. About one quarter of the site’s Super Bowl in-play bets came via the Simplebet product, which offered “micromarket” bets, like the outcome of the next play or drive. Bevilacqua said they favored bets similar to those that were popular in the FTP game.

“That’s remarkable for a company that only launched its first live product in real money betting four weeks ago, with no marketing,” said Bevilacqua, whose company recently signed on to provide in-play micromarket odds for MLB’s “Rally” FTP game. “I think that information is eye opening. It’s a small sample, so I don’t want to get too far over my skis. But that’s why I’m very interested to get a full year of MLB under our belts. Then we’ll see how user behavior between free to play and eventually real money betting in baseball matches up.”

Breaking Down The Second Half Of 2020

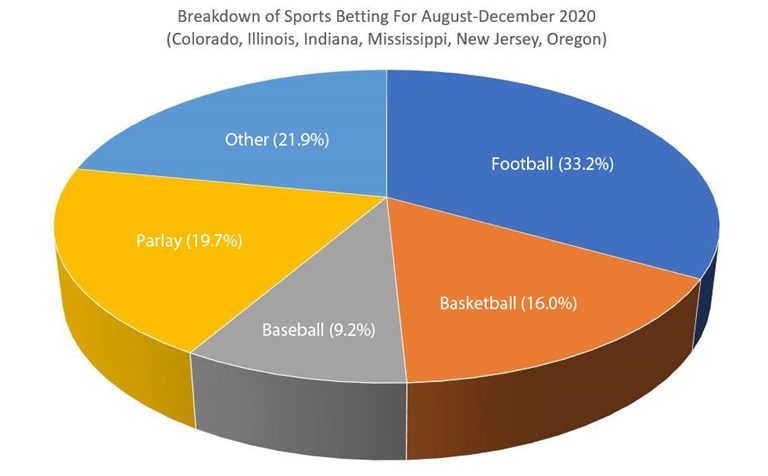

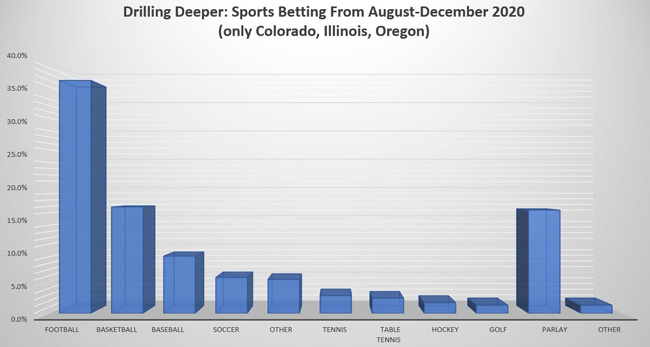

Here’s a look at what bettors wagered on in the second half of last year in the six states that report that data. Regulators in three of those states report only football, basketball and baseball, but three others get more specific.

Speed Reads

- A bill that would allow pro teams to run sportsbooks in Arizona "advanced Wednesday night" through the state Senate -- "something the state's tribes with casinos have historically opposed," notes the Arizona Republic. The bill "not only would allow 20 sport betting licenses, half to tribes and half off the reservations but also would allow fantasy sports betting off the reservations." Sports betting also "could be done remotely on mobile devices."

- Following up on an item we had in the last edition of SBJ Betting, Yahoo Sports said it posted a massive uptick in referrals to BetMGM during Super Bowl week, driving six times more in account deposits as it did during an average NFL week. Perhaps more importantly, referrals from Yahoo are proving more valuable than those from most channels, with the average handle per bettor trending at more than $6,000 per year. The Yahoo Sportsbook page offers lines and odds, with links driving users to BetMGM in states in which online sports betting is legal.

- The debut of FoxBet’s “Win Clint’s Money” NASCAR Super Six promotion attracted about 423,000 contest entries during the second stage of the Daytona 500. A spinoff of the “Win Terry’s Money” promo featured during "Fox NFL Sunday" marked FoxBet’s first in-race, free-to-play contest. The sportsbook’s standard NASCAR FTP contest attracted about 900,000 entries.

- BetMGM and Topgolf have a new partnership that includes BetMGM digital branding throughout Topgolf venues in cities where BetMGM operates, including Las Vegas, Indianapolis, Nashville, Detroit, Virginia Beach and Denver. The pact also includes branding within the WGT by Topgolf platform.

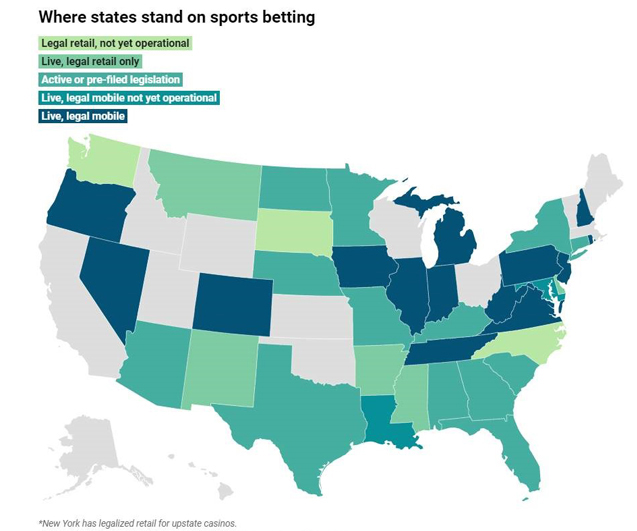

- Having a hard time keeping up with what’s legal where on the sports betting front? Us too. Here’s a handy-dandy map to help you keep track.